Hong Leong Bank Moratorium Housing Loan 2021

B40 individual or household. An important thing to note is that opting for the moratorium will still incur additional interest charges.

Hong Leong Bank Post Moratorium Payment Relief Assistance Plans Supporting The Government S Extended Covid 19 Relief Initiatives Malaysia Sme

N line with the six-month bank loan repayment moratorium under the Pemulih.

Hong leong bank moratorium housing loan 2021. Kuwait Finance House Malaysia. For individuals B40M40T20 the bank is offering two plans for customers to choose from the first being a six-month deferment of instalments and the other is a 50 reduction of instalments for six months. Fixed rates home loan packages are popular because they provide the stability and security to hedge against other financial risks we may carry.

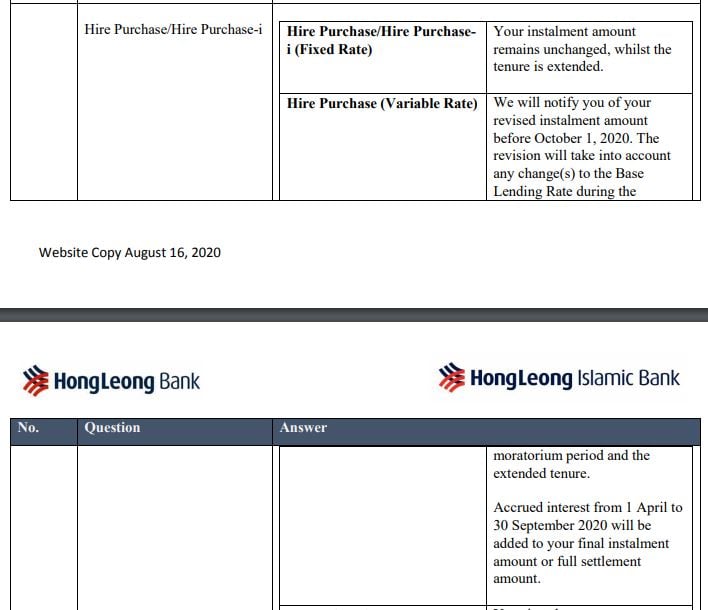

Hong Leong Investment Bank Researchs analyst Chan Jit Hoong agreed that the opt-in loan moratorium is unlikely to have a significant impact on banks. 3-month deferment of instalments. Hong Leong Bank has announced available plans under its Payment Relief Assistance programme and we take a look at that for car loans.

You can get 35 of your principal loan reimbursement at the end of your loan term. MORATORIUM AUTOMATIK TANPA SYARAT PAKEJ PEMULIH 2021. Just a self-declaration is needed.

March 25 2020 1806 pm 08. 30 year s Please provide your details and let our experts assist you. The only catch is that this moratorium is NOT automatic.

Hong Leong Bank offers a wide collection of housing loans including their Flexi Mortgage that shows up with a bullet payment element. Hong Leong Bank offers six-month moratorium on loan repayments provides measures for cardholders as well. Hong Leong Housing Loan Moratorium.

Hong Leong Bank To Extend Targeted Payment Relief Assistance To Customers Into 2021. Please contact your bank from 7 July 2021 onwards for details. Anyone 18 years old or above may apply for this Hong Leong mortgage package.

2021 Hong Leong Bank Pemulih Moratorium 6-month deferment or 50 instalment reduction for six months. Hong Leong Bank Berhad Hong Leong Islamic Bank Berhad. - A A.

This plan allows customers to convert their outstanding credit card balance into a term loan with the option to opt-in for a 36-month instalment plan at an effective interest rate of 13pa. In this category the 5 banks that emerge as winners are Standard Chartered Bank Maybank DBS Hong Leong Finance and HSBC. Hong Leong Bank Public Bank Affin Bank CIMB Agrobank and BSN.

Applications for this is open until 30 June 2021. Hong Leong Bank To Extend Targeted Payment Relief Assistance To Customers Into 2021. If you have a home loan and your monthly mortgage is RM1600 and you are renting it out for RM1600 as well it means you do not need to pay your RM1600 which is a savings and you get rental of RM1600.

Reduce your monthly instalment payments by 25 50 or 75 for six months commensurate with your pay cut or financial situation. Covid 19 Hong Leong Bank Offers Six Month Moratorium On Loan Repayments Provides Measures For Cardholders As Well The Edge Markets. Hong Leong Bank Bhd and Hong Leong Islamic Bank Bhd have offered their customers the option of converting their credit.

BORANG PERMOHONAN MORATORIUM 2021Borang WebSENARAI HOTLINE HUBUNGI BANKMaybankCIMBRHBBank IslamPublic BankBSNHong LeongAffin BankAmbankOCBC Alliance BankAgrobankCitiBankSMEBank By KekandaMemey On July 8 2021. Six-month loan moratorium is available to all individuals B40 M40. Must already be registered with Bantuan Sara Hidup BSH Bantuan Prihatin BPR Option 1.

Those interested in taking the moratorium from HLB and needing specific details can contact the bank at 03-79591888 or 03-76268899 or via e-mail at email protected Applications can also be made via this e-Form. Hong Leong Housing Loan Moratorium. Flexible packages for any budget.

Covid 19 Hong Leong Bank Offers Six Month Moratorium On Loan Repayments Provides Measures For Cardholders As Well The Edge Markets. More banks have come forward to say that they will not be charging compounding interest on their loans during the six-month moratorium period. KUALA LUMPUR March 25.

Selecting RA package 2021-06-28 1145am. Flat interest rate 71pa. TERKINI PERMOHONAN MORATORIUM UNTUK B40 M40 PKS DAN GOLONGAN YANG TERJEJAS MAYBANK PUBLIC BANK AMBANK RHB BANK CIMB BANK BANK ISLAM BSN BANK RAKYAT AFFIN BANK MBSB BANK HONG LEONG BANK AL RAJHI BANK SME BANK AGROBANK CITIBANK HSBC OCBC DAN LAIN-LAIN Moratorium.

Interestprofit will continue to accrue on. Pay only the interestprofit for a period of up to 15 months until December 2021. If we examine net profits for Q1 2021 at the group level we can observe examples of healthy profits from Maybank RM 243 billion Hong Leong Bank RM 772 million and RHB RM 651 million.

50 reduction in instalments for 6 months. Interest for individual and SME loans from these banks will not be compounded during the deferment period mandated by Bank Negara Malaysia. Most importantly we observe that once the moratorium has ended based on the financial standing in Q1 2021 the ease of recovery for the banks was evident.

One would need to apply if one wants this moratorium.

2021 Hong Leong Bank Pemulih Moratorium For Car Loans Deferment Or 50 Reduction For Six Months Paultan Org

Hong Leong Bank Posts Facebook

Solid Growth For Hong Leong Bank In Q1 The Star

Hong Leong Bank Dear Customers Our Branches Nationwide Facebook

Promotion Enjoy Rewards When You Pay The Safer Way

Watch Out Addition Of Interest Accrued From April September In Post Moratorium Financial Assistance

Hong Leong Bank To Extend Targeted Payment Relief Assistance To Customers Into 2021

Hong Leong Bank Posts Facebook

Posting Komentar untuk "Hong Leong Bank Moratorium Housing Loan 2021"