Highest Income Tax Rate In Malaysia

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region. Malaysia Personal Income Tax Rate.

World S Highest Effective Personal Tax Rates

Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020.

Highest income tax rate in malaysia. Corporate Tax Rate in Malaysia remained unchanged at 24 percent in 2021 from 24 percent in 2020. A non-resident individual is taxed at a flat rate of 30 on total taxable income. Tax Relief For Year Of Assessment 2020 Tax Filed In 2021 Chapter 5.

There is a 6 increase from 2018 which was RM2482 keeping up with inflation while helping companies attract the most qualified candidates. Malaysias finance minister presented the 2020 Budget proposals on 11 October 2019 and announced an increase in individual income tax rates by 2 percent. There is also an increase and expansion of the scope of individual tax reliefs eg for the provision of child-care and early.

On the first 35000 Next 15000. Youll still need to pay taxes for income earned in Malaysia and will be taxed at a different rate from residents. Personal income tax at the highest rate is still only 27.

How Does Monthly Tax Deduction MTDPCB Work In Malaysia. Corporate Tax Rate in Malaysia averaged 2612 percent from 1997 until 2021 reaching an all time high of 30 percent in 1997 and a record low of 24 percent in 2015. 28 of Income Tax rate is applicable for these types of Income.

The Malaysia Income Tax Calculator uses income tax rates from the following tax years 2021 is simply the default year for this tax calculator please note these income tax tables only include taxable elements allowances and thresholds used in the Malaysia Monthly Income Tax Calculator if you identify an error in the tax tables or a tax credit threshold that you would like us to add to the tax. According to a report in 2019 Malaysian fresh graduates are earning an average of RM2635 a month. 13 рядків Review the 2020 Malaysia income tax rates and thresholds to allow calculation of salary.

On the First 20000 Next 15000. What Is Tax Rebate. Malaysia Income Tax Rates in 2021.

How To Pay Income. Inland Revenue Board of Malaysia. Corporate tax rate for resident small and medium-sized entreprises with capitalisation under MYR 25 million 17 on the first MYR 600000 24 above MYR 600000.

A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020. Additionally taxes like estate duties annual wealth taxes accumulated earnings tax or federal taxes are not levied in Malaysia. Thats a difference of RM1055 in taxes.

On the First 10000 Next 10000. Tax Rates For Year Of Assessment 2020 Tax Filed In 2021 Chapter 6. The Personal Income Tax Rate in Malaysia stands at 30 percent.

In addition taxes like estate duties annual wealth taxes accumulated earnings tax or federal taxes are not levied in Malaysia. 226 рядків A comparison of tax rates by countries is difficult and somewhat subjective as tax laws in. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity.

On the First 5000 Next 5000. Corporate tax for companies originating in the Territory of Labuan and operating a trading activity in this territory. The income tax with the highest rate only recently being at 28 has been cut down now to 26 for residents and 27 for non-residents.

Personal Income Tax Rate in Malaysia averaged 2729 percent from 2004 until 2020 reaching an all time high of 30 percent in 2020 and a record low of 25 percent in 2015. 10 of tax rate applies to Royalty rent earned by non-residents. On the First 2500.

Public Entertainer Interests received by non-resident. Corporate tax standard rate. Calculations RM Rate TaxRM 0-2500.

Malaysia Increase in Top Rate Among Measures Affectin. What Is Income Tax Return. 20182019 Malaysian Tax Booklet.

Malaysia Income Tax e-Filing Guide. You are regarded as a non-resident under Malaysian tax law if you stay in Malaysia for less than 182 days in a year regardless of nationality. 3 of the audited income.

Income Taxes in Malaysia For Non-Residents.

List Of Countries By Tax Rates Wikipedia

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

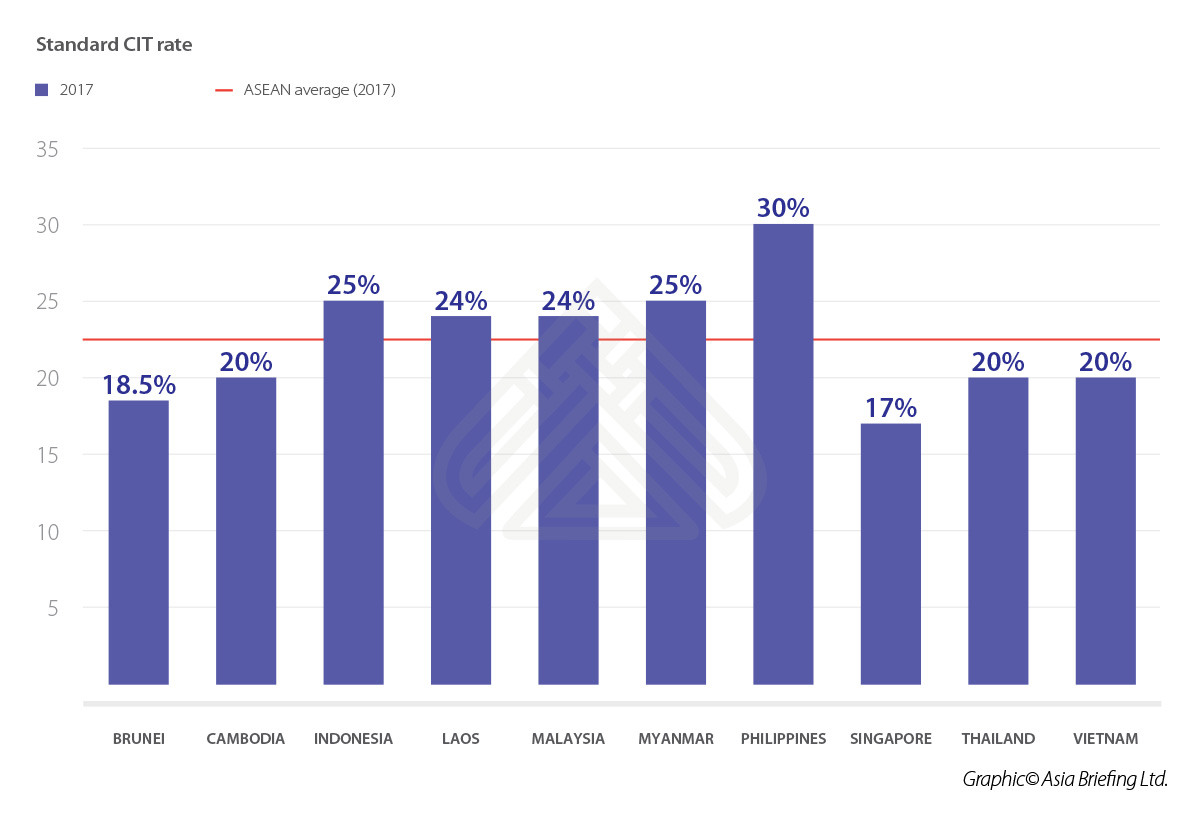

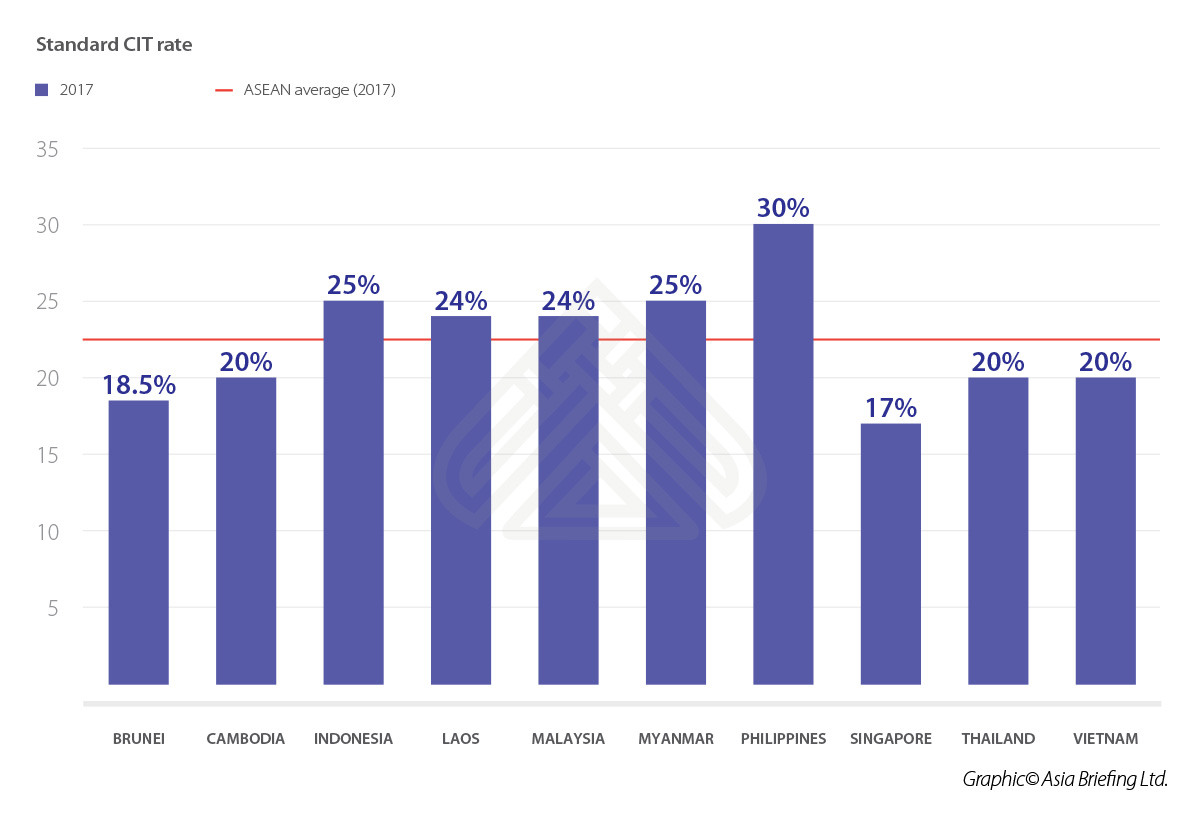

Comparing Tax Rates Across Asean Asean Business News

World S Highest Effective Personal Tax Rates

Malaysia Personal Income Tax Rate 2004 2021 Data 2022 2023 Forecast Historical

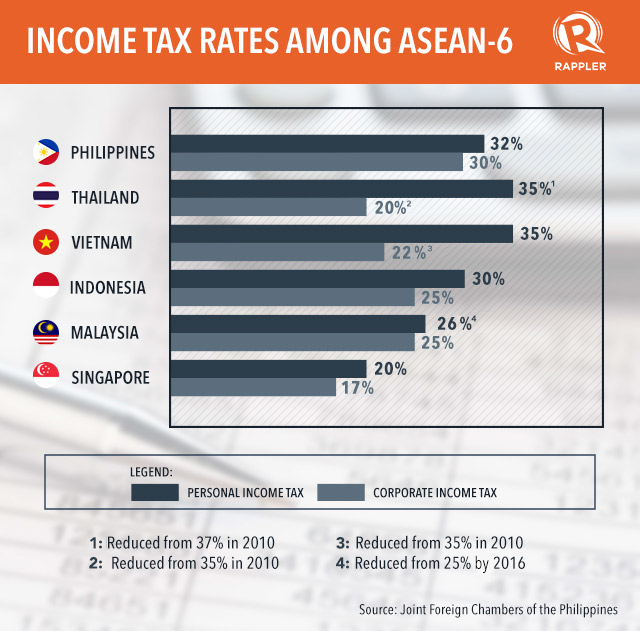

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Taxing High Incomes A Comparison Of 41 Countries Tax Foundation

Individual Income Tax In Malaysia For Expatriates

Why Ph Has 2nd Highest Income Tax In Asean

Comparing Tax Rates Across Asean Asean Business News

Comparing Tax Rates Across Asean Asean Business News

Posting Komentar untuk "Highest Income Tax Rate In Malaysia"